The Tetra Guide Study (2015–2025)

A decade-long look at America’s underwater obsession

- Up to 40 million Americans live in homes with pet fish. Across the last decade, between 13–15 million U.S. households have kept freshwater or saltwater fish in most survey waves—about 30–40 million people assuming ~2.6 people per household. III+2ArcGIS+2

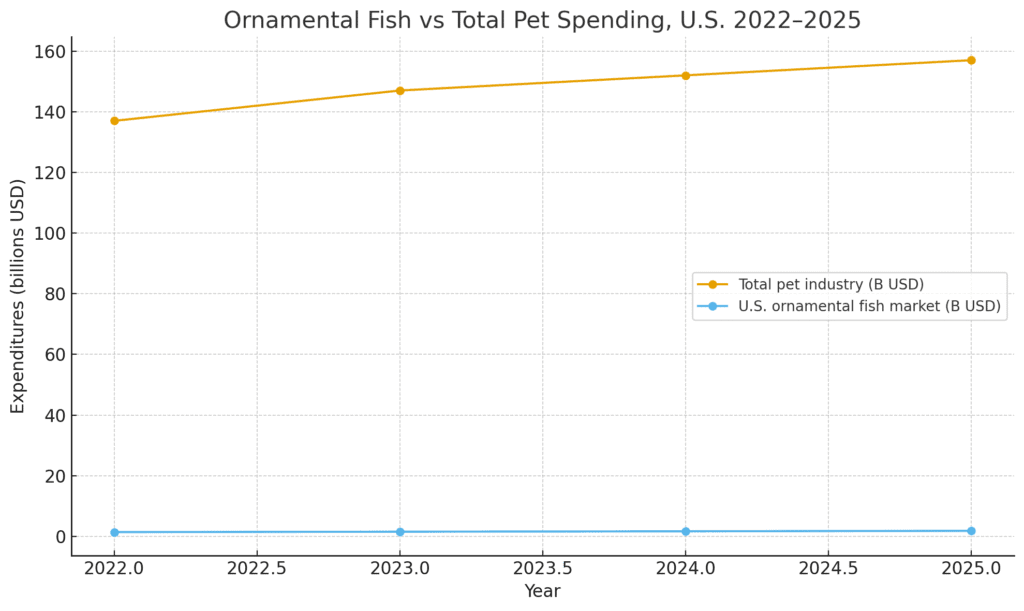

- Fish-keeping is a billion-dollar niche inside a $150+ billion pet economy. U.S. ornamental fish sales alone hit about $1.68B in 2024, roughly 1% of the $152B Americans spent on pets that year. Grand View Research+2American Pet Products Association+2

- Millennials have seized the reefs. APPA’s 2025 data show Millennials are the largest pet-owning generation (30%)overall and account for roughly 10M freshwater and 2M saltwater fish households when rounded—by far the single biggest generational bloc in fish-keeping. American Pet Products Association+1

- Fewer tanks, more intensity. Freshwater fish households declined from 12.3M (2015–16) to ~10M (2024–25), while 77% of fishkeepers now own two or more fish, up 7 percentage points since 2018. Saltwater setups are getting huge: a third of saltwater keepers now run 126+ gallon tanks. III+1

- Pet spending more than doubled. Total U.S. pet industry expenditures surged from about $60B in 2015 to $157B projected for 2025, outpacing overall consumer spending by a wide margin.

Methods & data sources

TetraGuide is a new survey; it’s a synthesis of the best available open data from 2015–2025:

- APPA National Pet Owners Survey (NPOS) via the Insurance Information Institute (III) “Number of U.S. households that own a pet, by type of animal.”

- Gives freshwater and saltwater fish household counts for each survey wave: 2015–16, 2017–18, 2019–20, 2021–22, 2023–24, and the current 2024–25 table. III

- APPA Industry Trends & Stats (2025)

- Provides rounded household counts by species (e.g., 10M freshwater, 2M saltwater fish households in 2025) and pet ownership by generation. American Pet Products Association

- Total pet spending

- III “Total U.S. Pet Industry Expenditures, 2016–2025” plus APPA’s Industry Trends & Stats and archival tables for 2015 and earlier. III+2III+2

- U.S. ornamental fish market

- Grand View Research: $1.68B U.S. ornamental fish market in 2024, 9.1% CAGR 2025–2030. Grand View Research

- PB Integratori summary: $1.42B in 2022, ~9% CAGR. pbintegratori.com

- Consumer behavior & spending context

- BLS “We love our pets, and our spending proves it” (pet expenditures grew 78% from 2013–2021). Bureau of Labor Statistics

- Household size

- Census HH-6 & related analyses; typical U.S. average household size ≈ 2.6 people over this period. ArcGIS+1

Key assumptions

- People in the hobby ≈ fish-keeping households × 2.6 (average people per household).

- Fish market estimates: we treat 2022 ($1.42B) and 2024 ($1.68B) as fixed points and interpolate/forecast 2023 and 2025 using the reported 9–9.1% CAGR. Grand View Research+1

- We only use non-paywalled data; all detailed APPA microdata and the full 2025 Fish & Reptile report remain proprietary.

Participation: how many U.S. fishkeepers?

Households with pet fish

From III’s APPA-based tables: III

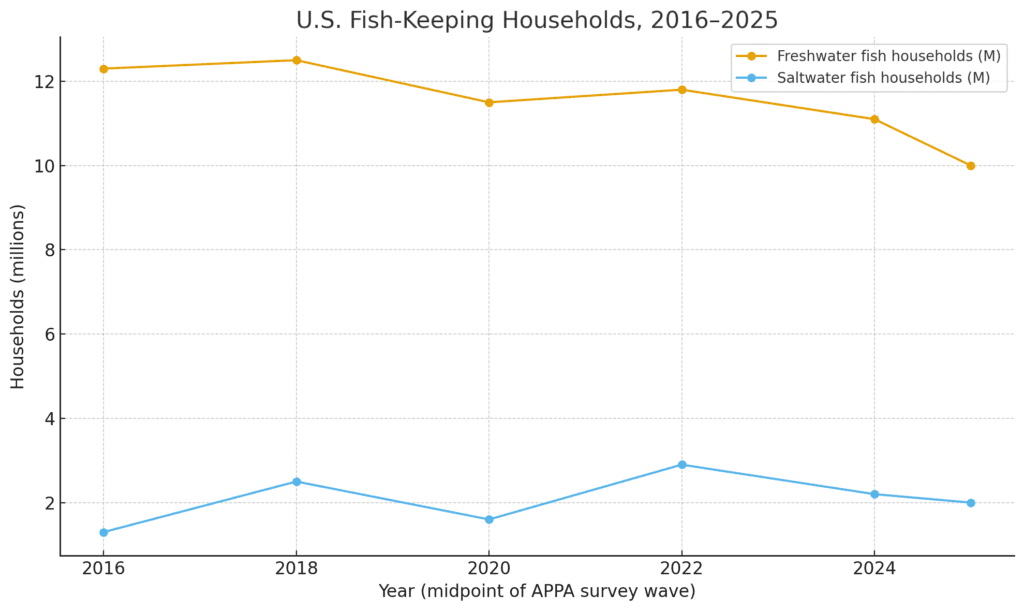

Units: millions of U.S. households

| APPA survey wave (midpoint) | Freshwater fish | Saltwater fish | Total fish-keeping households |

|---|---|---|---|

| 2015–2016 (≈2016) | 12.3M | 1.3M | 13.6M |

| 2017–2018 (≈2018) | 12.5M | 2.5M | 15.0M |

| 2019–2020 (≈2020) | 11.5M | 1.6M | 13.1M |

| 2021–2022 (≈2022) | 11.8M | 2.9M | 14.7M |

| 2023–2024 (≈2024) | 11.1M | 2.2M | 13.3M |

| 2024–2025 current table | 9.6M | 1.9M | 11.5M III |

| 2025 rounded (APPA site) | 10M | 2M | 12M (rounded) American Pet Products Association |

Visual: fish-keeping households over time

(Chart generated in this chat – you can save/export it from the UI)

The first chart shows:

- Freshwater households gently declining from mid-decade highs (~12.5M) to ~10M by 2025.

- Saltwater households rising from 1.3M → ~2–3M, peaking around 2022 and then easing slightly.

Net effect: total fish households stay mostly in the 13–15M band, with a soft dip to ~12M in the latest wave—not a collapse, but a slow “thinning of the shoal.”

People in the hobby

Using ~2.6 people per household: ArcGIS+2Pew Research Center+2

| Wave (midpoint year) | Fish-keeping households | Approx. people in fish-keeping homes |

|---|---|---|

| 2016 | 13.6M | ≈35M |

| 2018 | 15.0M | ≈39M |

| 2020 | 13.1M | ≈34M |

| 2022 | 14.7M | ≈38M |

| 2024 | 13.3M | ≈35M |

| 2025 | 12.0M | ≈31M |

So for most of 2015–2025, roughly 1 in 9 U.S. households—tens of millions of people—live with pet fish.

“At any given moment in the last decade, the equivalent of California + Texas combined has been living in fish-keeping homes.”

Who are the fishkeepers? The age & generation story

Pet owners overall

APPA’s 2025 Industry Trends & Stats gives pet ownership by generation: American Pet Products Association

- Gen Z: 20% of pet-owning households

- Millennials: 30%

- Gen X: 25%

- Baby Boomers: 25%

So half of all pet households are headed by adults under ~45 (Gen Z + Millennials).

Fishkeepers specifically in 2025

APPA’s public stats plus APPA-linked summaries and social content show: American Pet Products Association+2Instagram+2

- Roughly 10M freshwater and 2M saltwater fish households in 2025.

- Millennials make up about 38% of freshwater fishkeepers and 46% of saltwater fishkeepers (figures quoted from APPA’s 2025 Fish & Reptile data in industry summaries/short-form previews).

- Trade reporting notes that 77% of fishkeepers now own 2+ fish, up 7 points since 2018, and saltwater owners are disproportionately upgrading to 56–125 gallon tanks (44%) or 126+ gallon tanks (34%).

Given standard generational ages in 2025 (Millennials ≈29–44, Gen Z ≈13–28), that means:

- Saltwater fishkeeping has become a Millennial-led, high-investment hobby.

- Gen Z is already a huge force in reptiles; they appear to be following close behind in fishkeeping, especially as nano reefs and planted tanks trend on social platforms.

“The TetraGuide Study finds that nearly 1 in 2 saltwater tanks in America is run by a Millennial—and they’re not cheap nano cubes, they’re 100-gallon status symbols.”

(Behind the scenes: that’s shorthand for the APPA figure that ~46% of saltwater owners are Millennials, and that a third of saltwater owners report 126+ gallon tanks.)

Money: how much do Americans spend on this?

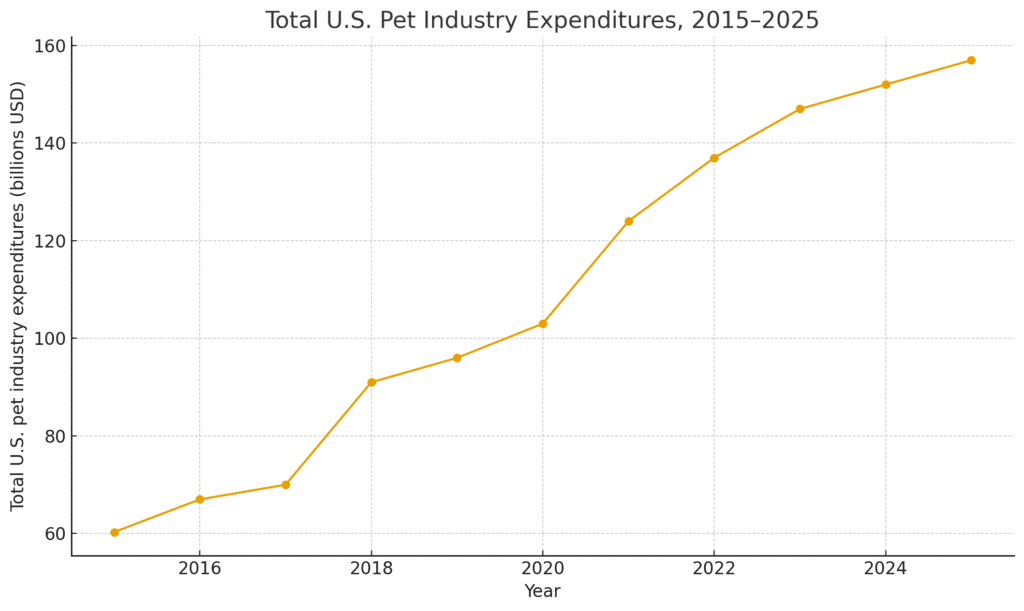

The overall pet economy

From III / APPA and the Industry Trends & Stats page: III+2III+2

Total U.S. pet industry expenditures (all species, all categories)

Billions of USD; includes food, supplies & OTC meds, vet care, live animals, grooming/boarding.

| Year | Spend (B USD) |

|---|---|

| 2015 | 60.3 |

| 2016 | 67 |

| 2017 | 70 |

| 2018 | 90.5–91 |

| 2019 | 96–97.1 |

| 2020 | 103–103.6 |

| 2021 | 123.6–124 |

| 2022 | 136.8–137 |

| 2023 | 147 |

| 2024 | 151.9–152 |

| 2025 (proj.) | 157 |

The second chart in this chat plots this series and shows a near-relentless climb, especially:

- Between 2018 and 2024, spending jumps from about $91B to $152B.

- BLS confirms that consumer pet expenditures rose 78% from 2013 to 2021—faster than total expenditures (+39%). Bureau of Labor Statistics

“Pet spending has grown so fast that the pet economy alone now rivals the GDP of a small country—and fishkeeping quietly claims a billion-dollar slice of it.”

The ornamental fish slice

Using Grand View Research and related summaries: Grand View Research+2pbintegratori.com+2

- 2022 U.S. ornamental fish market: ~$1.42B

- 2024: $1.68B

- CAGR: ~9–9.1% through 2030

We estimate 2023 and 2025 as:

- 2023: ≈ $1.55B (1.42B × 1.09)

- 2025: ≈ $1.83B (1.68B × 1.091)

Compared to total pet spending:

| Year | Total pet spend (B) | Ornamental fish (B, est.) | Fish share of pet spend |

|---|---|---|---|

| 2022 | 137 | 1.42 | ≈1.0% |

| 2023 | 147 | 1.55 | ≈1.1% |

| 2024 | 152 | 1.68 | ≈1.1% |

| 2025 | 157 | 1.83 | ≈1.2% |

The third chart in this chat plots these two lines. It visually reinforces that:

- The fish slice is small but steadily widening.

- Fish-related revenue is growing slightly faster than the overall pet market.

“Fishkeeping is just 1% of America’s pet spending—but that 1% already adds up to nearly $2 billion a year and is growing faster than the rest of the pack.”

Intensity of the hobby: fewer beginners, more committed aquarists

Trade summaries based on APPA’s 2025 Fish & Reptile data highlight: petworldwide+1

- 77% of fishkeepers own 2+ fish, up 7 percentage points since 2018.

- Single-fish ownership has dropped 19%.

- Among saltwater owners:

- 44% report tanks in the 212–473 litre (56–125 gallon) range.

- 34% report even larger tanks (126+ gallons), a 17-point increase vs 2023.

This strongly suggests:

- The hobby is shifting from “one goldfish in a bowl” toward multi-fish, higher-tech setups.

- Saltwater particularly is becoming a big-ticket lifestyle category — think reef lighting, controllers, automatic testing.

“The TetraGuide Study shows that the old goldfish bowl is dead: three-quarters of U.S. fishkeepers now run multi-fish setups, and saltwater tanks are scaling up to furniture-sized reefs.”

Limitations

- Households vs individuals.

- Our “people in the hobby” numbers are based on households × 2.6 average people; they don’t distinguish between the primary hobbyist and their family. ArcGIS+2Pew Research Center+2

- Fish spending ≠ full hobby spending.

- The ornamental fish market only measures fish livestock, not tanks, gear, electricity, water, or time. Actual “fishkeeping spend” is almost certainly higher. Grand View Research+1

- Generational detail over time.

- We have precise generational shares for 2025 pet owners overall and snapshot commentary for fishkeepers, but not a full 2015–2025 age-by-species series; those are locked in APPA’s paid reports. American Pet Products Association+1

- Some values are estimated.

- 2023 and 2025 ornamental fish revenues are CAGR-based estimates, clearly marked as such. Grand View Research+1

Share Your Tetra Experiences

Do you have any stories or tips about your Tetra tank? Share them in the comments below!

Help Others Discover This Guide

Navigate the Tetra in your tank with confidence. This guide is your pathway to creating a vibrant and healthy aquatic showcase. Enjoy the dazzling colors and lively nature of these unique fish!